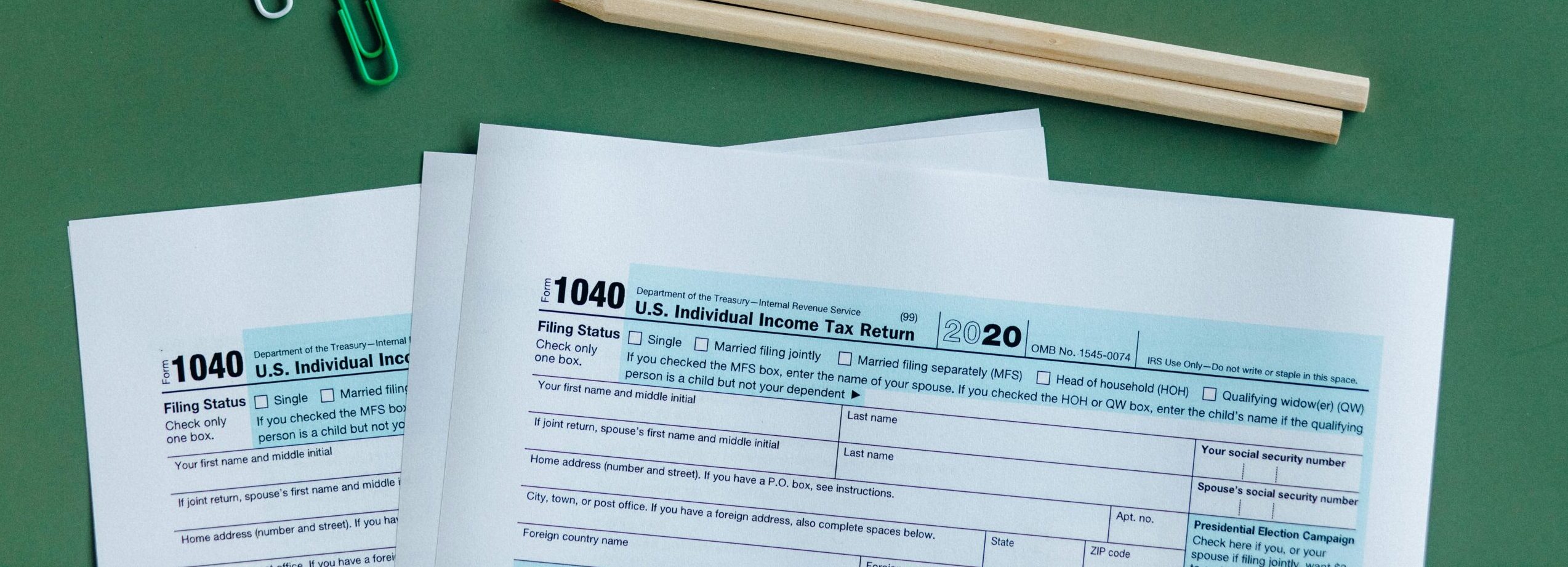

Personal Tax Preparation

We understand the importance of accurate and timely personal tax preparation. Our experienced team is dedicated to guiding individuals through the complexities of tax laws, maximizing deductions, and minimizing liabilities. Whether you’re a freelancer, a small business owner, or an employee, we tailor our services to suit your unique financial situation. From gathering necessary documents to filing returns, we provide comprehensive support to ensure compliance and peace of mind.

At Annabi Accountancy Corp, we provide:

Tax consultation and planning

Providing personalized guidance on tax strategies to minimize liabilities and maximize refunds.

Income tax return preparation

Assisting individuals in preparing and filing federal, state, and local income tax returns accurately and on time.

Deduction and credit optimization

Identifying eligible deductions and tax credits to reduce taxable income and increase potential refunds.

Tax resolution services

Representing clients in negotiations with tax authorities and resolving tax disputes, penalties, and audits.

Investment income tax reporting

Assisting clients in reporting and optimizing taxes related to capital gains, dividends, and interest income.

Rental property tax management

Advising property owners on tax implications, deductions, and record-keeping requirements for rental income.